Feedback

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

When UPP began assuming management for the pension assets of participating organizations in July 2021, we identified opportunities within the combined portfolio to enhance long-term performance. As a result of our findings, we developed a multi-year transition plan toward one unified and cost effective portfolio tailored to UPP’s funding objectives and investment beliefs.

UPP’s target asset mix is specifically designed to fund our pension benefits for the long term. It will help us maintain a healthy funding and liquidity position, stay well-equipped to pay members’ pensions, and remain agile to investment opportunities as markets evolve. The pace at which UPP can shift toward our target asset mix depends on both structural and transitionary elements, including market movement, liquidity, available investment opportunities, and the duration of investment commitments within the original portfolios. For more information on our target asset mix see our:

Where we're headed

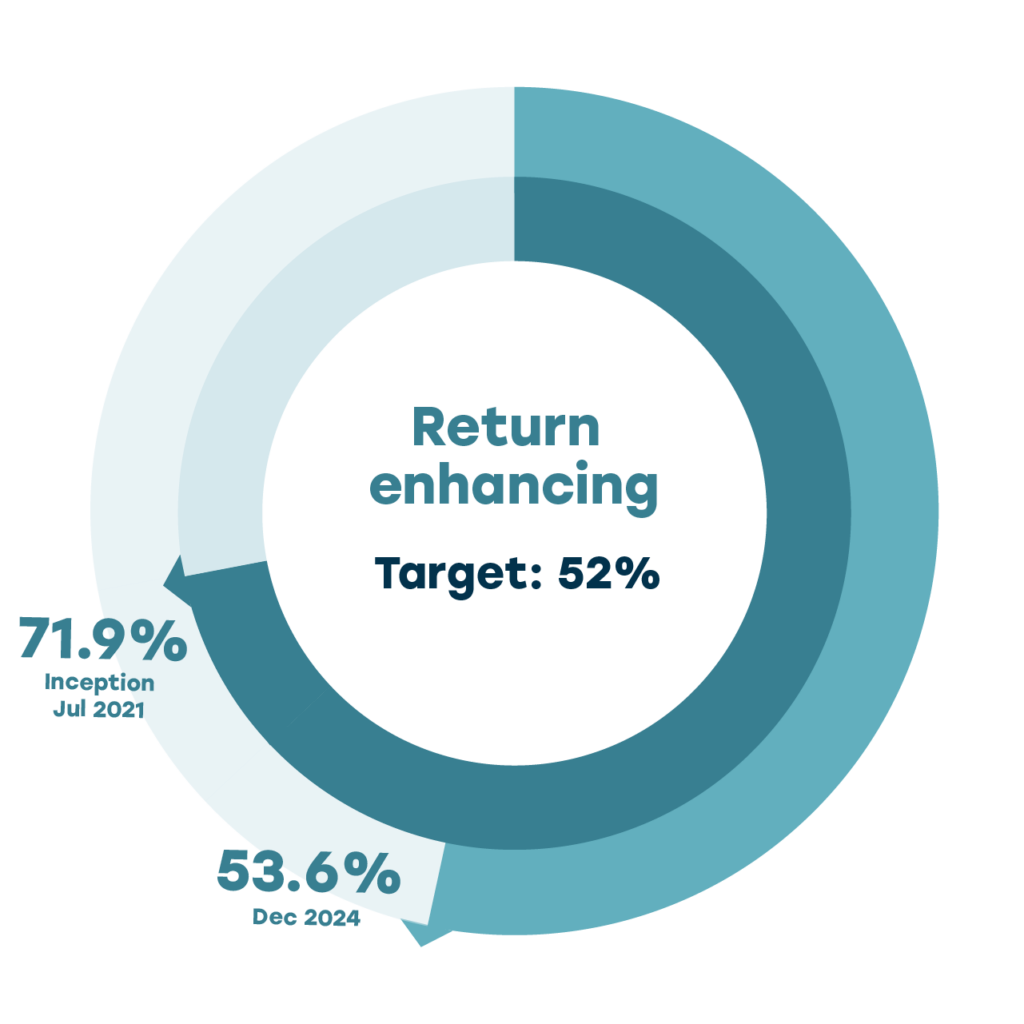

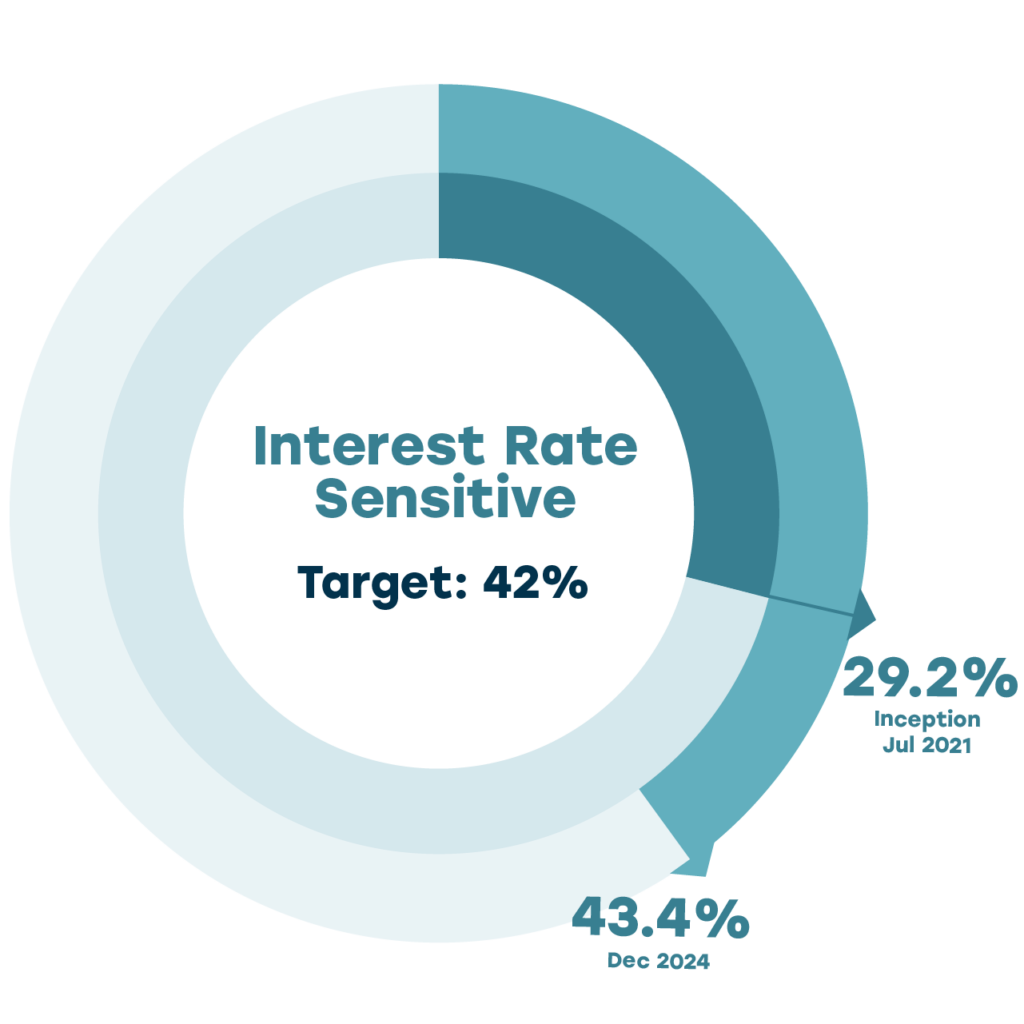

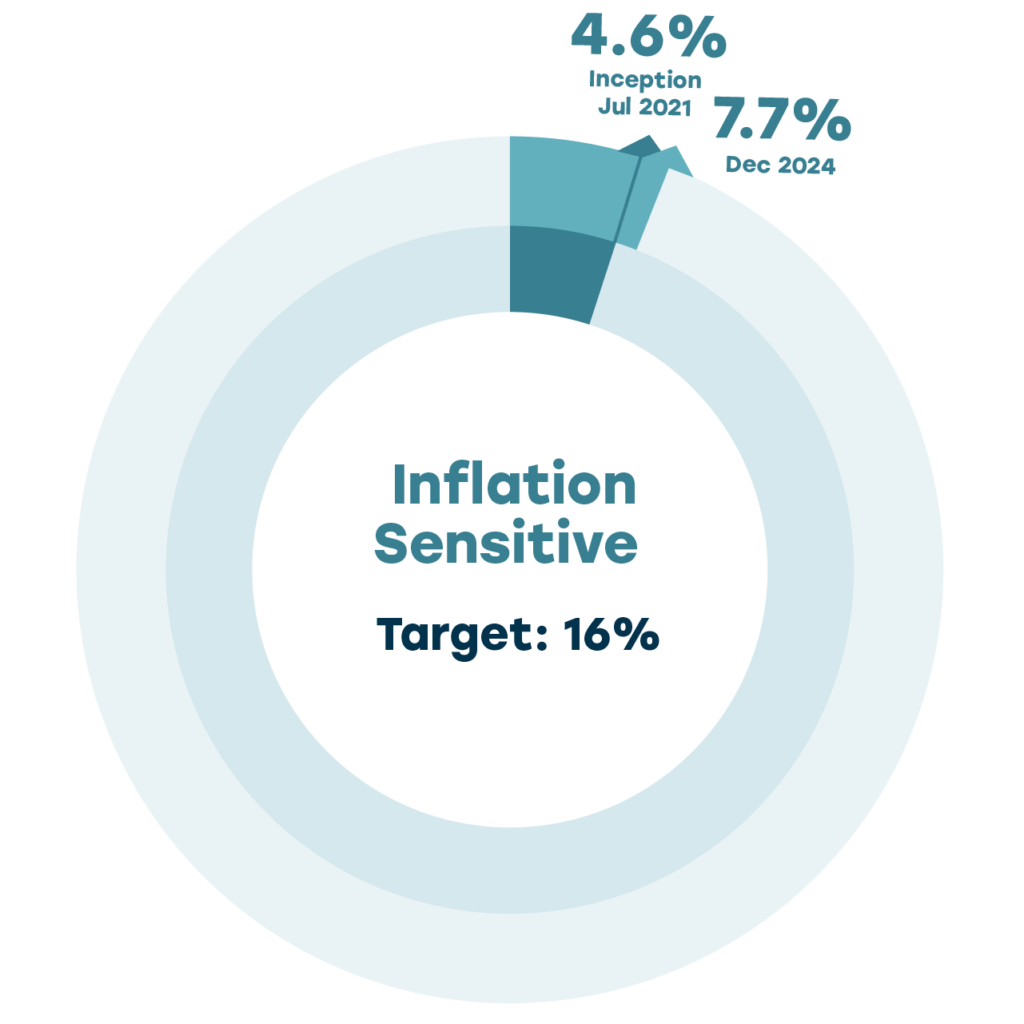

The Plan’s asset mix is diversified across a broad range of asset classes, organized in three categories: return enhancing, interest rate sensitive, and inflation sensitive. Under this structure, we divide our total fund assets based on their exposure to key economic drivers as well as their risk-return characteristics and roles in funding the pension.

In line with our target asset mix, we explore new investments with a focus on enhanced cost efficiency and control, alignment with our members’ needs, and long-term value.

Since embarking on our portfolio transition journey, we have made significant progress in shifting our exposure toward certain asset classes. In 2024, we further reduced our exposure to public equities and increased our investments in interest rate–sensitive assets. We also increased our allocation to inflation-hedging assets, including investing in renewable energy, digital infrastructure, and multi-residential real estate. These shifts support better portfolio alignment with our investment approach and pension liabilities. We continuously explore new investments that reflect this priority.

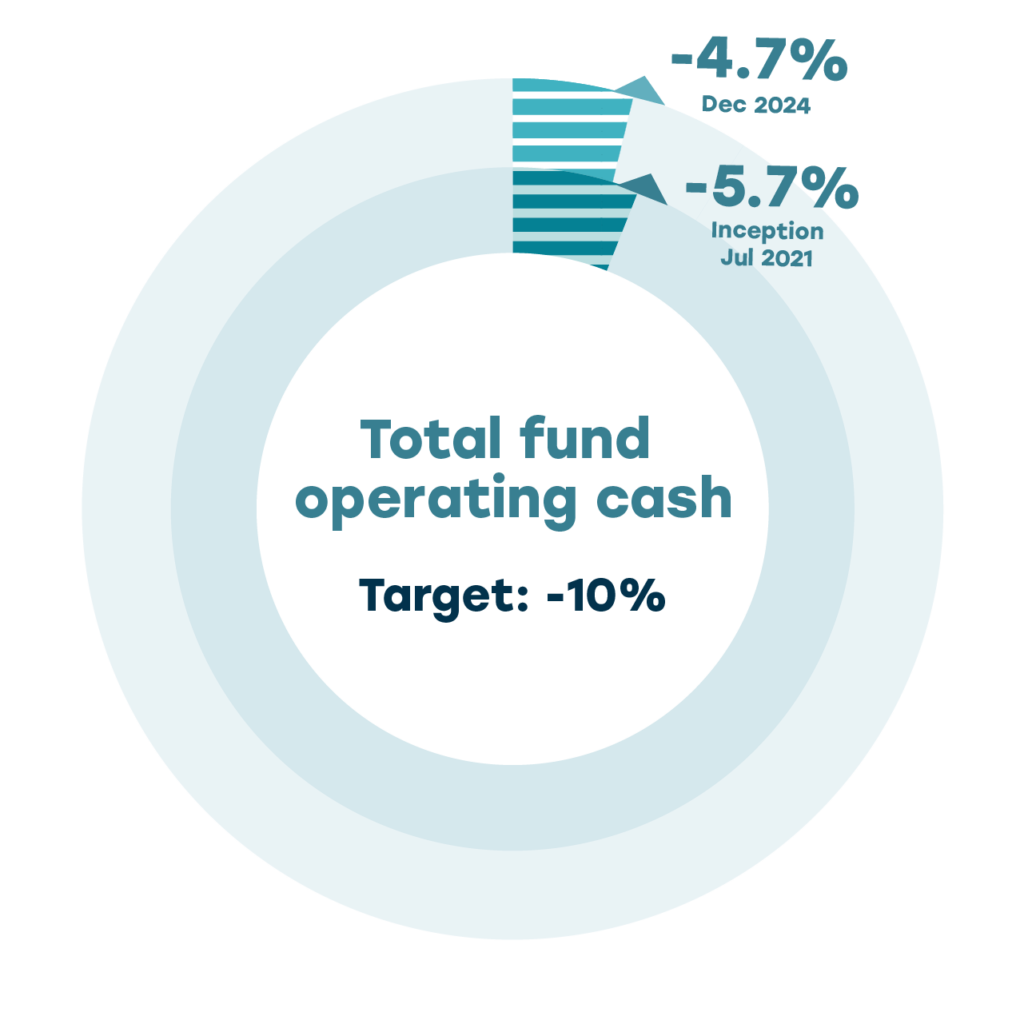

Inception July 1, 2021 – December 2024

Return enhancing strategies: generally reduce funding risk over the long term by delivering higher relative rates of return. They can, however, display higher relative volatility (a measure of market risk) in the short term.

Asset subclasses: public equities, private equities, private debt, absolute return.

Interest rate sensitive strategies: generally reduce funding risk over the long term by helping offset the effects of changing interest rates to our assets and liabilities. This includes long-dated government bonds, which are a stable source of long-term returns and help align our fixed income portfolio with the interest rate sensitivity of our liabilities.

Asset subclasses: fixed income, inflation sensitive bonds

Inflation sensitive strategies: provide stable long-term returns while helping mitigate the impact of inflation on the long-term value of the Plan liabilities, which are linked to salary levels and partially indexed to changes in inflation.

Asset subclasses: infrastructure,

real estate

Total fund operating cash: helps us dynamically change our exposures in a fast-moving market. Proactive liquidity planning ensures we can maintain our desired asset mix and meet our liability obligations while remaining a reliable source for markets when liquidity is scarce.

Following our investment in Copenhagen Infrastructure Partners (CIP)’s flagship fund, UPP has co-invested alongside Copenhagen Infrastructure V (CI V) in a portfolio of development-stage renewable energy assets. This investment offers multiple benefits to UPP’s members and investment portfolio including external fee savings, diversification across technologies and geographies, and attractive risk-adjusted returns through long-term, inflation-indexed cash flows. It also aligns with UPP’s commitment to invest in climate solutions.

UPP participated in its first direct loan in the latest private debt financing for CoreWeave, a cloud-based provider specializing in high-performance computing resources for AI and machine learning applications. This investment diversifies UPP’s private credit portfolio into the IT sector and aligns with their direct participation model, offering greater control, transparency, and reduced external fees.

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

Customize your experience through accessibility adjustments