Feedback

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

Addressing the risks associated with climate change and encouraging the transition to a resilient, net-zero world.

This Climate Stewardship Plan (“Plan”) sets out the steps UPP will take in 2023-2025 to realize the stewardship commitments of our Climate Action Plan and address the risks associated with climate change and encourage the transition to a more resilient world with net-zero GHG emissions.

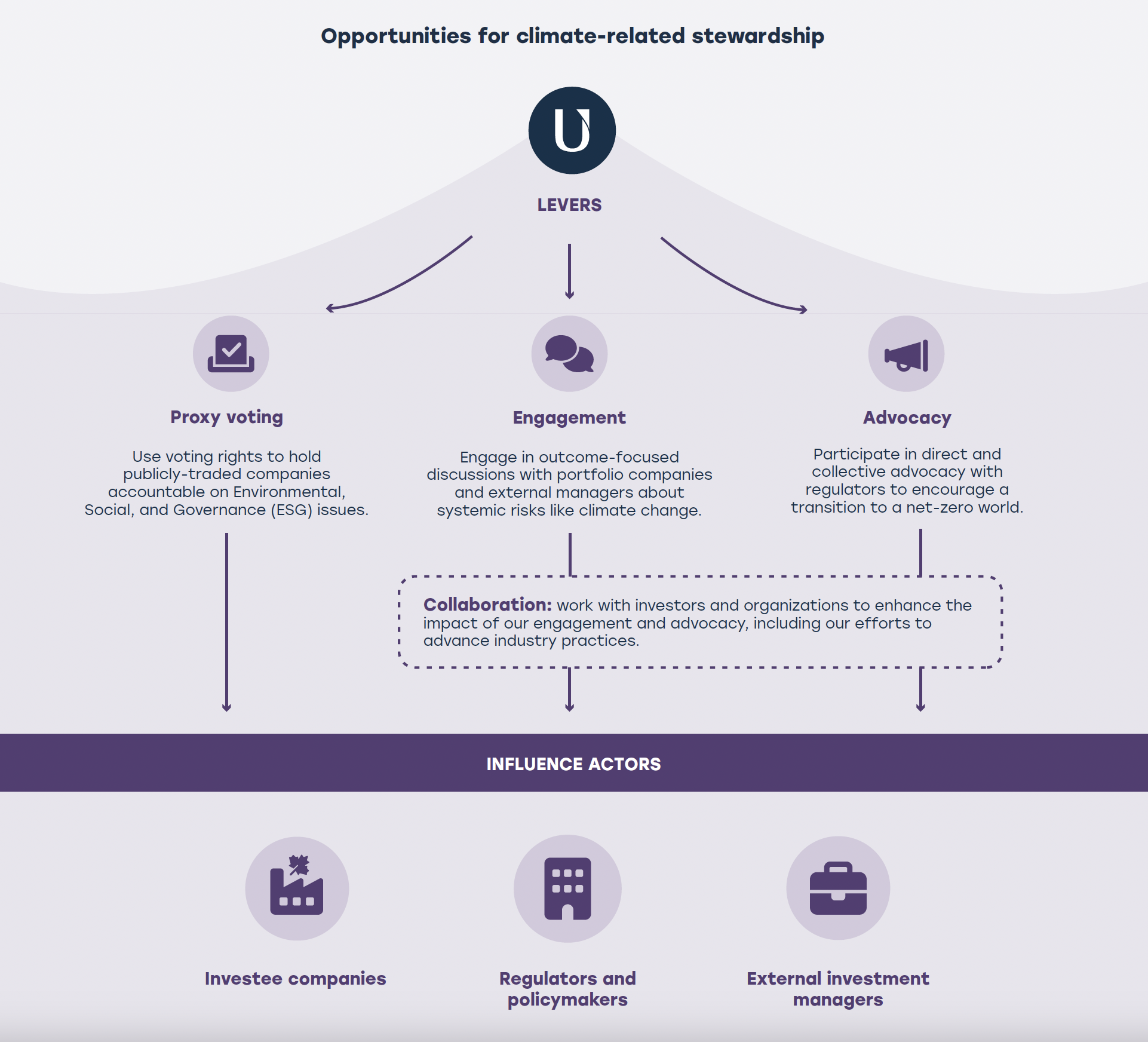

In our Climate Action Plan, we established a bold set of climate-related commitments acknowledging that our ability to deliver adequate investment returns for our members’ pensions depends on a stable climate, and that UPP has a role in ensuring the stability of the climate. Stewardship is central to achieving these commitments.

Engagement: engaging with companies in our portfolio and our external investment managers through direct and collaborative dialogue to support their transition to a resilient, low-carbon, and net-zero business strategy.

Proxy voting: using our shareholder rights to vote for initiatives that support the net-zero transition and elect boards that provide adequate oversight of climate-related risks and opportunities.

Advocacy: advocating for policies and regulations consistent with the goals of the Paris Agreement , including mandatory climate and transition plans.

What is stewardship? “Also known as ‘active ownership’, stewardship is the use of influence by institutional investors to maximise overall long-term value including the value of common economic, social and environmental assets, on which returns and clients’ and beneficiaries’ interests depend.” — UN Principles for Responsible Investment

While no single institution can claim success when a company, policy maker, or investor takes concrete steps to address climate-related systemic risks, we will measure the success of UPP’s contributions by assessing progress on indicators such as:

Following engagement by UPP, high climate-impact companies reduce their emissions in line with credible pathways, and proactively manage their transition to net zero by 2050.

After UPP’s advocacy, regulators implement policy tools to support management of climate risks and opportunities.

UPP’s external managers exercise proxy voting, company engagement, or advocacy in support of climate transition, following our dialogue with them.

We have selected 27 companies across three categories as the focus of our engagement activities: banks as important allocators of capital that will shape climate transition, high-emitting Canadian companies where UPP engagement can add value, and oil companies with an outsized impact on UPP’s carbon footprint. When selecting companies we considered:

company size and weight in UPP’s investments,

opportunities for engagement,

materiality of the companies to UPP’s carbon footprint,

importance of the companies to real economy climate transition, and

availability of metrics and data to measure progress.

Our engagement goals and approaches for each of the three company categories are outlined below.

|

Banks – allocators of capital that shape climate transition |

Goals:

UPP will participate in collaborative engagement with the banks through the Institutional Investors Group on Climate Change (IIGCC) and through our engagement service provider, SHARE . We will assess progress annually based on results of the Transition Pathways Initiative Net Zero Banking Assessment report , company disclosures, and SHARE engagement reporting. |

| High-emitting Canadian companies |

Goals:

UPP will engage with the companies through Climate Engagement Canada (CEC) and SHARE. We will assess progress annually based on results of the CEC Net Zero Benchmark , information from our external managers, company disclosures, and SHARE engagement reporting. |

|

Oil companies with outsized carbon footprint impact |

Goals:

We will conduct bilateral engagement with the companies through targeted written requests for information about their alignment to the Climate Action 100+ Net Zero Benchmark or the CEC Net Zero Benchmark . We will evaluate the responses we receive, and refine UPP’s position on ongoing investment in these companies as appropriate. |

As a shareholder in publicly traded companies, we use our voting rights to communicate expectations and hold companies accountable on governance issues, including those related to climate change.

Our Proxy Voting Policy states our positions and expectations of companies in the form of guidelines on important ballot issues focused on enhancing the long-term economic interests of shareholders. Our votes are publicly disclosed on our proxy voting page.

Goals

Through the proxy voting-related actions in this Plan, we seek to:

Action Plan

2023: Initiate votes against directors

2024: Escalate with strengthened guidelines

2025: Communicate votes to amplify impact

We believe that UPP has a duty to advocate for effective rules and regulations on behalf of our members for the good of the fund and for the good of the economic, social, and environmental systems on which long-term fund performance relies.

Effectively managing a systemic issue like climate change requires market regulation to facilitate and incentivize behaviour consistent with addressing the challenge. UPP selectively communicates with regulators and policymakers—either independently or with like-minded peers—to encourage fair and efficient public policy, government regulations, and market systems that support a well-managed transition to a net-zero world and UPP’s broader sustainability objectives.

Goals

Through our climate policy advocacy, we aim to:

Advocacy approach

We will advocate for the regulatory interventions necessary to ensure near complete coverage of Canada’s economy with climate-related financial disclosures. UPP will also support development of a Canadian green and transition taxonomy and the domestic adoption of the International Sustainability Standards Board standards. Where capacity permits UPP will support industrial policy that facilitates real economy transition and express concern with policies that are misaligned. In doing so UPP will refrain from partisanship or statements that could be perceived as partisan.

UPP will prioritize advocacy on policy issues in Canada. However, we will monitor and from time to time may provide input to international regulatory frameworks and standards where we believe that our voice will have meaningful impact, including by actively participating in collaborative investor action networks and initiatives .

The Climate Transition Investment Framework was created to support the commitments outlined in UPP’s Climate Action Plan. It supports our ability to manage the impacts of climate-related risks on fund performance and capitalize on opportunities for long-term value creation.

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

Customize your experience through accessibility adjustments