UPP Climate Action Plan

The University Pension Plan Ontario (“UPP”) recognizes that climate change continues to present risks and opportunities for our investment portfolio. We also recognize that climate change presents a systemic and material risk to the ecological, societal, and financial stability of the economy as a whole.

We believe that our approach to addressing climate change should be grounded in science and supportive of international agreements like the Paris Agreement of the Parties to the United Nations Framework Convention on Climate Change. We also believe that addressing climate change as outlined below reflects our fiduciary duty and is in the best interest of our members.

1.0 Introduction

The materiality of climate change for UPP is twofold:

To address these challenges, we have the following interrelated objectives for our approach

to climate change:

UPP’s ability to realize adequate investment returns and provide retirement benefits depends on a stable climate; and

UPP’s investments affect the stability of the climate.

This Climate Action Plan (“Plan”) outlines our context and our climate-related commitments.

2.0 Context

We make our climate commitments with the

expectation that governments will follow through

on their own commitments to ensure the objectives

of the Paris Agreement are met. Our commitments

are based on our interpretation of what the science

tells us about the imperative to reduce greenhouse

gas emissions, our investment beliefs, what we have

heard from UPP’s members and what we understand

to be our mechanisms as an investor to catalyze the

transition to a resilient, net-zero world.

"It is indisputable that human activities are causing climate change, making extreme climate events, including heat waves, heavy rainfall, and droughts, more frequent and severe.”

Intergovernmental Panel on Climate Change

2.1 Global greenhouse gas (GHG) emissions have risen quickly and need to fall faster

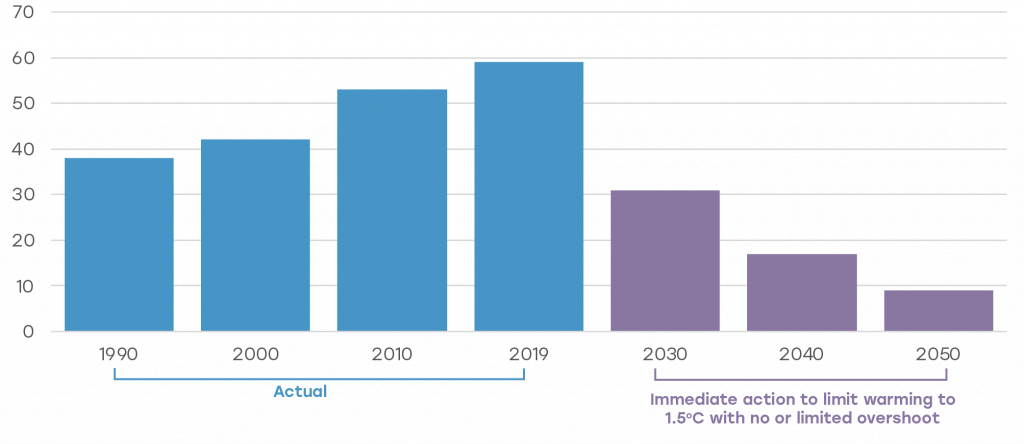

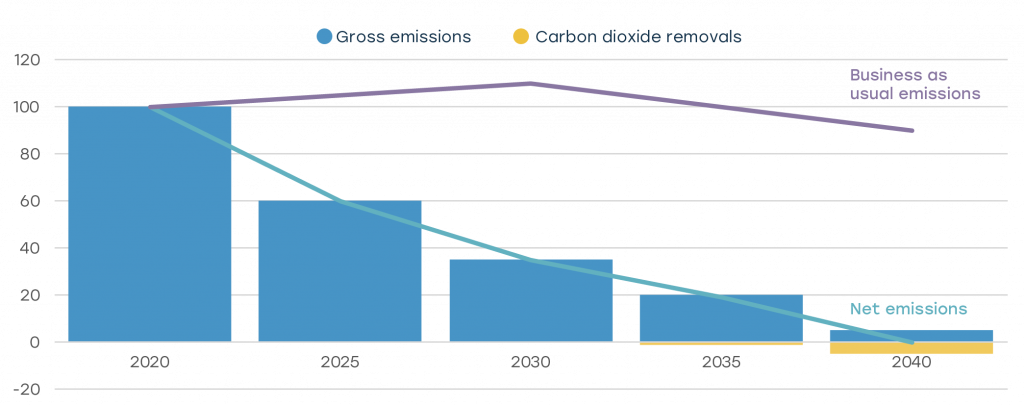

Global GHG emissions have risen quickly in past decades and now approach nearly 60 billion tonnes CO2-eq per year. As shown in Figure 1, emissions now need to drop even more quickly than they rose to limit warming to 1.5°C with no or limited overshoot.

Unfortunately, society is not reducing GHG emissions as fast as the science indicates we should to limit the temperature rise to 1.5°C and this divergence creates a substantial challenge for UPP as we seek to achieve a net-zero portfolio in a net-zero world.

2.2 Society can limit the global average temperature rise to 1.5°C

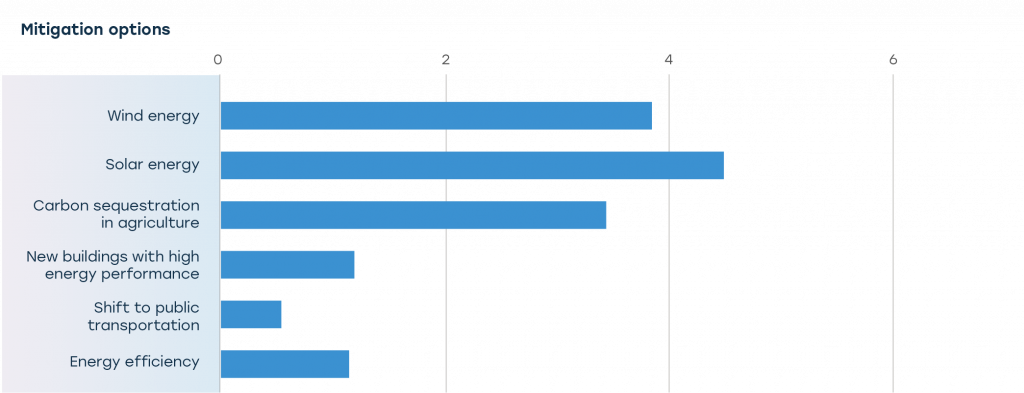

In the long-term, GHG emissions need to approach zero and the remaining emissions need to be removed from the atmosphere if we are to stabilize the climate. As noted above, annual emissions need to decline rapidly to limit warming to 1.5°C. Figure 2 demonstrates that there are many technological solutions available now to substantially reduce net GHG emissions by 2030. Many of the solutions would likely have a greater chance of success if governments legislated and enforced emission reductions, implemented coordinated global pricing of carbon and there was much more investment in solutions.

2.3 A rise of 1.5°C is preferable to a rise of 2°C or more

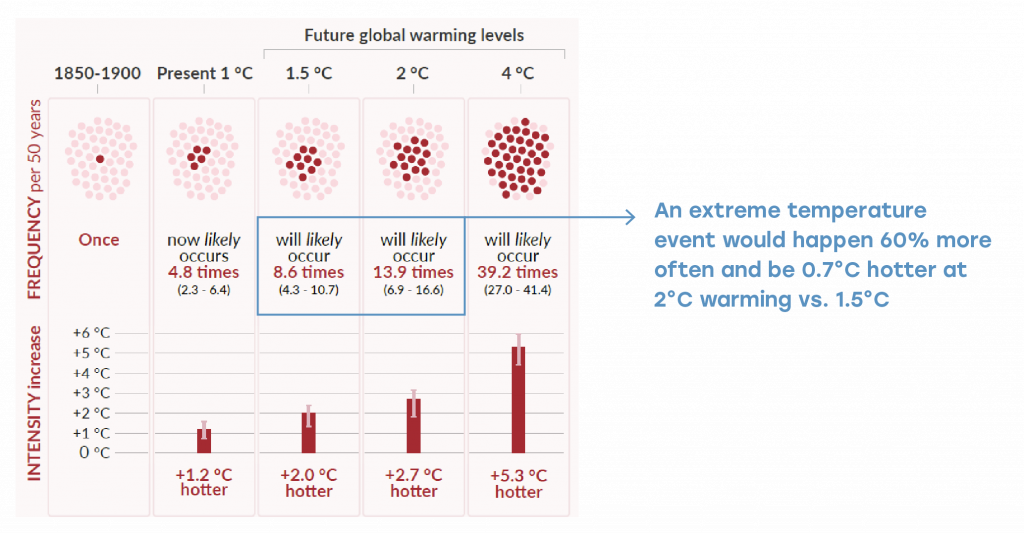

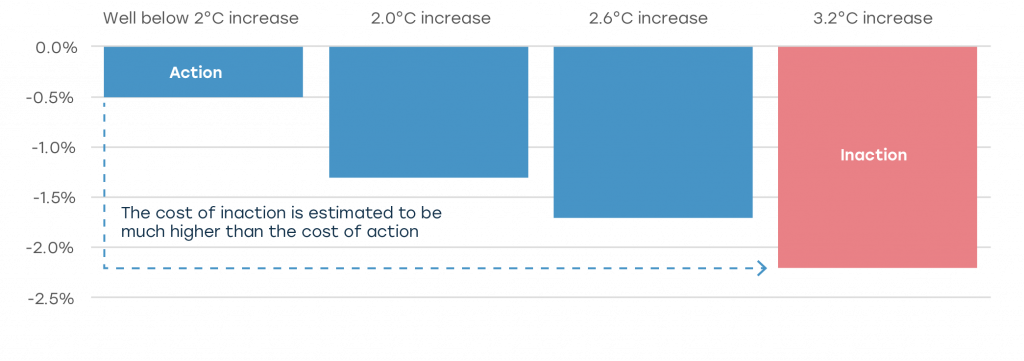

Extreme weather events will be larger in frequency and intensity with every additional degree of global warming as shown in Figure 3. Efforts to stabilize the climate at as low a temperature rise as possible will result in better outcomes for the environmental and social systems on which the economy relies. Indeed, it is unlikely that there will be any long-term economic winners in a climate-changed world and more change will make things worse as shown in Figure 4.

2.4 Our climate-related investment actions are guided by our investment beliefs

Earlier in 2022, UPP documented a Statement of Investment Beliefs , which serves as our “North star” and guides our investment strategy. The following investment beliefs inform our approach to climate change:

As a long-term investor, UPP has a responsibility to promote the health of the capital markets and the financial, environmental, and social systems on which capital markets rely.

Creating value and managing risk involve exercising UPP’s voice to influence outcomes related to material issues through active ownership, policy advocacy, collaboration with other investors and stakeholders – all of which must be approached with the same intention and rigor as selecting investments.

All aspects of investing should be forward-looking and intentional. Successful investing requires rigorous research and analysis, alignment with UPP’s capabilities and focused innovation.

UPP embraces partnership as a foundation for enhanced performance and impact.

Transparency engenders trust. Our investment of members’ pension earnings has bearing on their retirement security; they have a right to know how we approach and perform that responsibility.

2.5 UPP’s members want action on climate change

In winter 2022 we consulted members on responsible investing perspectives and priorities through two discussion forums and a survey.

UPP’s members clearly indicated combating climate change as the top priority for UPP’s approach to responsible investing, both as a social and financial imperative.

Most respondents indicated that the following approaches are preferred for UPP when it comes to responsible investing:

- Invest in companies that are leaders on environmental, social and governance issues

- Avoid companies that are ‘laggards’ and not taking environmental, social and governance issues seriously

- Advocate for public policies and regulations that advance global environmental, social and governance goals

2.6 Investors have several mechanisms to catalyze the transition to a resilient, net-zero world

Investors have several mechanisms to influence investee companies and encourage the transition to a resilient, net-zero world. These mechanisms help drive improvements in companies’ climate-related activities and increase the climate-positive impacts of companies in the real world. Select mechanisms are outlined in Figure 5 below.

Figure 5. Mechanisms for investor climate impact*

Mechanism | Description |

|---|---|

| Engagement | Hold structured dialogue with investee companies intended to result in improved risk management and sustainable value creation and to support transition to a resilient, low carbon and net-zero business strategy. |

| Proxy voting | Elect boards that provide adequate oversight of climate-related risks and opportunities and support their company’s transition to a resilient, low carbon and net-zero business strategy. |

| Policy advocacy | Advocate for a policies and regulations consistent with the goals of the Paris Agreement including sector-based policies and mandatory climate and transition disclosure. |

|

Mechanism |

Description |

|---|---|

| Incentivizing improvements through screening | Create incentives for investee companies to improve their climate-related practices and transition to a resilient, low-carbon and net-zero business strategy by applying screening approaches that may shift asset prices. |

| Investing in climate solutions | Invest in economic activities that contribute substantially to reducing GHG emissions or adapting to climate change. |

*See Kölbel et al. (2020)3 as referenced in the Net-Zero Asset Owner Alliance’s Target Setting Protocol , second edition.

3.0 Commitments

Overarching commitments

- UPP will transition its investment portfolio to net-zero GHG emissions by 2040, or sooner – consistent with a maximum global average temperature rise of 1.5°C above pre-industrial temperatures in line with the objectives of the Paris Agreement

- UPP will emphasize climate resiliency and GHG emission reductions in the real economy

Evaluate

Evaluate climate-related risks, opportunities, and impacts of our current and prospective investments at the total fund and investment mandate levels.

Commitments:

- Implement a climate transition investment framework and evaluate our portfolio.

- Integrate climate risk and opportunity assessment into investment strategy and processes.

Invest

Invest in climate solutions and in line with the transition to a net-zero world and reduce the GHG intensity of our assets.

Commitments:

- Invest only in new mandates and assets that align with the transition to a net-zero world.

- Reduce our portfolio’s carbon footprint by 16.5% by 2025 and 60% by 2030 from a 2021 baseline (as measured by tonnes CO2-eq / $M invested).

- Set a target for new investments in climate solutions.

- Selectively exclude investments in companies that present significant climate risk.

Engage

Engage with portfolio companies and market actors, including asset managers, to encourage a transition to a resilient, low carbon, net-zero world, and sufficient climate-related disclosure.

Commitments:

- Engage with at least 20 companies through collective and direct engagement.

- Engage with external investment managers to encourage their engagement with companies and emission reductions.

Advocate

Advocate for public policy and market systems that support limiting the global average temperature rise to 1.5°C.

Commitments:

- Participate in direct and collective advocacy with policymakers.

- Join the UN-convened Net-Zero Asset Owner Alliance and support industry initiatives that advance climate action.

Governance and oversight

To support our climate commitments, we will formalize Board and management oversight of our Climate Action Plan including establishing performance objectives and providing regular updates on the Plan’s progress.

Reporting and transparency

We will publish targets and report on progress in line with the Net-Zero Asset Owner Alliance requirements and we will publicly report on our climate management practices annually in line with the Task Force on Climate-Related Financial Disclosures (“TCFD”) recommendations.

Operational GHG emissions

We will lower UPP’s operational GHG emissions to net-zero by 2040, or sooner.

Overarching commitments

Investors have several mechanisms to influence investee companies and encourage the transition to a resilient, net-zero world. As referenced in the Net-Zero Asset Owner Alliance’s Target Setting Protocol, second edition, Kölbel et al. (2020)3 describe the mechanisms available to investors to impact companies. Select mechanisms are outlined in Figure 5 below. The mechanisms encourage companies to improve their climate-related activities or increase the climate positive impacts of companies in the real world.

Evaluate

By having a better understanding of climate risks and opportunities, UPP’s investment teams, as well as the broader market, can make more informed decisions to manage risk, capitalize on opportunities and drive stable, long-term returns.

We will develop and maintain a climate transition investment framework to evaluate investment mandates, assets, and economic activities. Our framework will employ science-based criteria and thresholds and will draw on existing and emerging work in Canada and globally For example, the Paris Aligned Investment Initiative has developed an alignment maturity scale, as shown in Figure 7, and Canada’s Sustainable Finance Action Council is undertaking work to help develop a green and transition taxonomy roadmap for Canada.

Figure 7. Paris Aligned Investment Initiative’s alignment maturity scale

|

Mechanism |

Description |

|---|---|

| Climate solutions | Economic activities that contribute substantially to reducing GHG emissions. |

| Net-zero | Companies that have current emissions intensity performance at, or close to, net-zero emissions with an investment plan or business model expected to continue to achieve that goal over time. |

| Aligned | Companies with a 2050 goal consistent with achieving global net-zero, short- and medium-term emission reduction targets (scope 1, 2 and material scope 3), current emissions intensity performance is consistent with targets, disclosure of scope 1, 2 and material scope 3 emissions, a quantified plan setting out the measures that will be deployed to deliver emission reduction targets, and a clear demonstration that the capital expenditures of the company are consistent with achieving net-zero emissions by 2050. |

| Aligning | Companies with short- or medium-term emission reduction targets (scope 1, 2 and material scope 3), disclosure of scope 1, 2 and material scope 3 emissions, and a quantified plan setting out the measures that will be deployed to deliver emission reduction targets. |

| Committed to aligning | Companies with a 2050 goal consistent with achieving global net-zero. |

| Not aligned | All other companies. |

Source: Paris Aligned Investment Initiative4

We will further integrate climate risk and opportunity assessments into our investment strategy and investment processes. For example, as recommended by the Task Force on Climate-Related Financial Disclosures, we will evaluate the resilience of our investment strategy, taking into consideration different climate-related scenarios, including a 2°C or lower scenario. We will also procure metrics, datasets and access to service providers that will allow us to identify, assess and manage material climate-related risks and opportunities.

Invest

By investing in climate solutions and in line with the transition to a net-zero world, while reducing the GHG intensity of our assets, we are sending clear signals that we want companies to improve their climate-related practices and transition to resilient, low-carbon and net-zero business strategies. We believe that making profitable investments in these types of assets will create a more resilient portfolio and better outcomes for our members.

As soon as our new climate transition investment framework is operational, we will begin only investing in new mandates that align with the transition to a net-zero world. Over time, we will ensure that our entire investment portfolio aligns with the transition to a net-zero world without compromising on our necessary risk and return requirements.

With our climate transition investment framework in place, we will also set targets for new, non-concessionary investments in climate adaptation and mitigation solutions.

The Net-Zero Asset Owner Alliance has defined climate solution investments as,

investments in economic activities considered to contribute substantially to:

- Climate change mitigation (solutions substantially reducing greenhouse gases by avoiding, removing emissions/by sequestering carbon dioxide already in the atmosphere);

- Climate change adaptation (where that activity substantially contributes

to enhancing adaptative capacity, strengthening resilience and reducing

vulnerability to climate change).

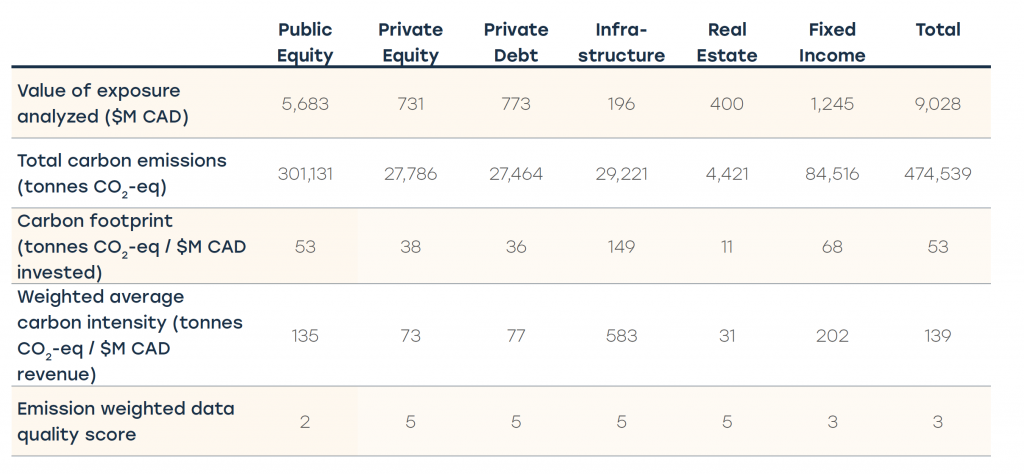

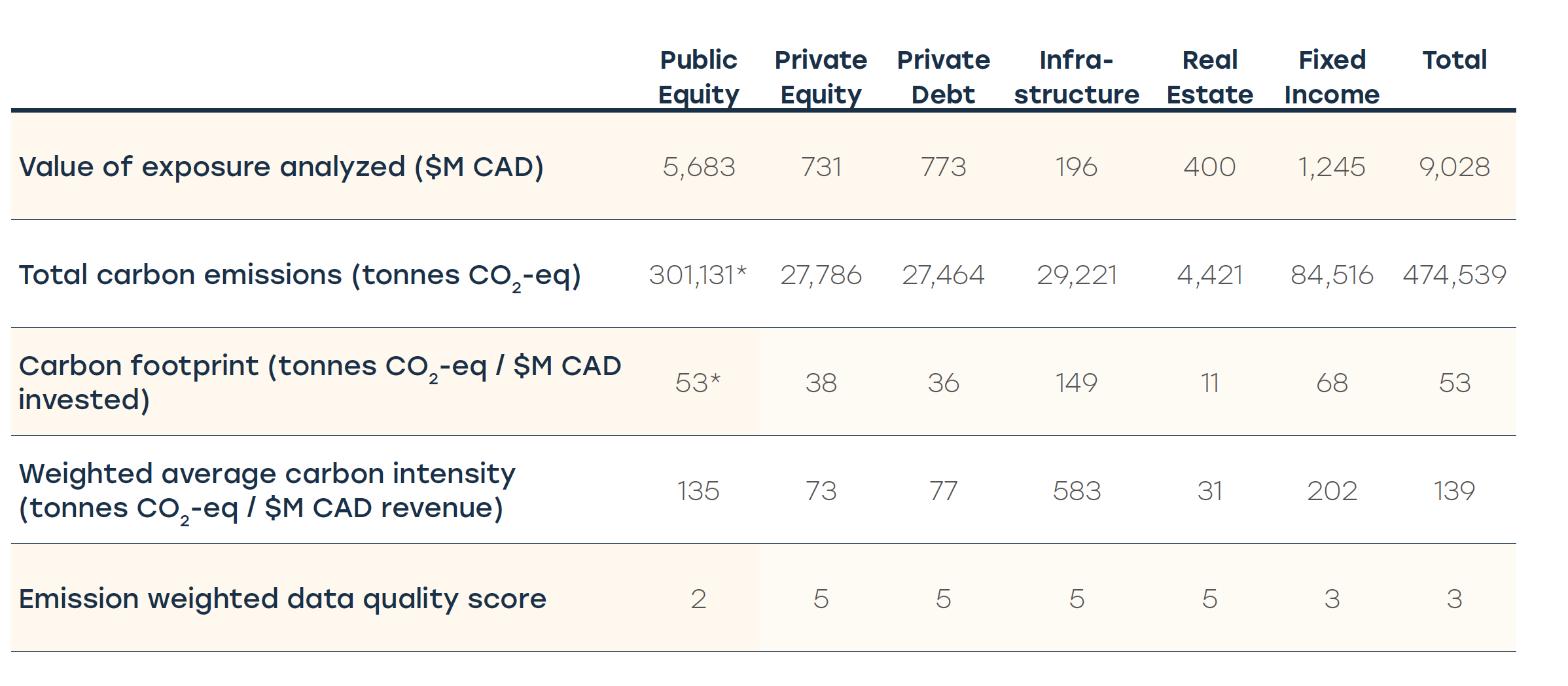

In support of our climate commitments, we have calculated the carbon footprint of UPP’s investment portfolio by assessing the GHG emissions associated with our investments as of December 31, 2021, as shown in Figure 8 and Figure 9. This carbon footprint forms the baseline for our commitment to reduce our portfolio’s emissions by 16.5% by 2025 and 60% by 2030. We will continue to calculate and report our carbon footprint annually to demonstrate progress towards our interim and long-term objectives. Combined, the results in Figure 8 and Figure 9 represent more than 70% of our net investment exposures as of December 31, 2021. Details on the scope and methodology of our carbon footprint calculations can be found in Appendix 1.

Carbon footprint methodologies and the attribution of GHG emissions to investors is an early and evolving process. Today, limited GHG emissions data is disclosed by investee companies, and what is disclosed is largely estimated and unverified by a third party. As such, calculating and disclosing our carbon footprint will be a journey of continual improvement that will see us seek to improve the quality of our data and methodology over time.

In general, UPP favours active engagement over excluding or selling investments as a first course of action to influence investee behaviours and will use constructive dialogue and clear guidance as primary tools to effect change. However, UPP’s Board of Trustees has enacted an Investment Exclusion Policy that outlines UPP’s approach towards ensuring UPP avoids financial and reputational risks related to environmental, social and governance (“ESG“) issues, such as UPP’s investments causing or contributing to adverse social or environmental impacts. The Policy is intended to help UPP provide stable retirement benefits at a reasonable cost for members, now and in the future.

Under the Investment Exclusion Policy, one of the first general parameters established relates to climate change and it will see UPP avoid investments in companies extensively participating in the mining or burning of thermal coal to generate electricity.

Engage

By engaging the companies we own and our external investment managers through bilateral and collaborative action, we can encourage the rapid and orderly transition to a resilient, low carbon, net-zero world. We also need to encourage these same parties to provide us and other market actors with sufficient climate-related disclosure to enable our evaluations and investment decisions.

We will engage at least 20 companies we own, with a focus on those responsible for the largest contributions to our carbon footprint. This engagement may be bilateral (directly between UPP and the company) or collaborative (via initiatives like Climate Action 100+ or Climate Engagement Canada).

We will also continue to engage our external investment managers in a dialogue to encourage their bilateral and collaborative engagement with companies they own on behalf of their clients and to encourage them to set emission reductions for the portfolios they manage.

Our engagement activity will be informed by science and common investor requests wherever possible such as the Net-Zero Asset Owner Alliance’s engagement requests to companies and asset managers, Climate Action 100+, and expectations prepared by investor groups like the Ceres Investor Network on Climate Risk and Sustainability or the Institutional Investors Group on Climate Change.

Advocate

By advocating for public policy, government regulations, and market systems that support

limiting the global average temperature rise to 1.5°C, we can help support the creation of the conditions necessary for the climate transition. We will undertake this advocacy bilaterally (via direct submissions and dialogue with policy makers) and collaboratively with other investors.

We will join the UN-convened Net-Zero Asset Owner Alliance and collaborate with other industry initiatives (some of which are mentioned above) that are working to advance climate action in the financial sector.

The UN-convened Net-Zero Asset Owner Alliance consists of 71 members with

more than $10 trillion of assets. It is convened by the United Nations Environment

Programme Finance Initiative and the Principles for Responsible Investment (PRI)

and is supported by WWF and Global Optimism, an initiative led by Christiana

Figueres, former Executive Secretary of the United Nations Framework

Convention on Climate Change (UNFCCC). The members of the initiative have

committed i) to transitioning their investment portfolios to net-zero GHG

emissions by 2050 consistent with a maximum temperature rise of 1.5°C above

pre-industrial levels; ii) to establishing intermediate targets every five years; and

iii) to regularly reporting on progress.

As of May 2022

Governance and oversight

To ensure we achieve our climate commitments and continuously improve upon them, the Board of Trustees will formalize its oversight of climate-related risks and opportunities. Management’s role in assessing and managing climate-related risks and opportunities will also be clarified. This will address how the board monitors and oversees progress

Reporting and transparency

We will publish targets and report on the progress of our Climate Action Plan in line with the expectations of the Net-Zero Asset Owner Alliance. We will also publicly report on our climate management practices annually in line with TCFD recommendations.

Operational GHG emissions

While the majority of our climate-related exposure comes from our investment portfolio, we also plan to address our operational GHG emissions and will pursue net-zero GHG emissions by 2040, or sooner.

Appendix – Carbon Footprint

Carbon footprint as calculated and disclosed in the July 2022 Action Plan release. See appendix 2 of our 2022 Annual Report for our most recent carbon footprint.

Methodology and Scope

Our methodology for calculating our carbon footprint is based on The Global GHG Accounting and Reporting Standard for the Financial Industry developed by the Partnership for Carbon Accounting Financials (“PCAF Standard”), which is widely adopted in the financial sector.

Emissions from UPP’s investments are attributed to UPP based on our proportional share of investment in the investee. For example, if UPP owns 1% of an investee’s enterprise value including cash, 1% of its GHG emissions are included in our carbon footprint.

Our carbon footprint metrics include the Scope 1 and Scope 2 emissions of investees and we have reported Scope 3 emissions for energy (oil & gas) and mining investments separately.

Three scopes of GHG emissions

- Scope 1 – direct GHG emissions from sources a company directly owns or controls

- Scope 2 – indirect GHG emissions associated with the electricity or heat a company

consumes - Scope 3 – indirect GHG emissions associated with a company’s value chain, including

for example emissions associated with products from a supplier, and emissions from its products when customers use them

Our methodology calculates carbon dioxide equivalent (CO2-eq) GHG emissions and includes the GHG emissions included in the Greenhouse Gas Protocol: Carbon Dioxide (CO2), Methane (CH4), Nitrous Oxide (N2O), Hydrofluorcarbons (HFCs), Perfluorcarbons (PFCs), Sulphur Hexafluoride (SF6) as well as Nitrogen Trifluoride (NF3).

We have calculated and disclosed the GHG emissions associated with our long investment exposures in equities and corporate fixed income (publicly traded and privately held), including the notional exposure of synthetic equity and fixed income investments. We have not included short exposures.

We have excluded government bonds, cash, cash equivalents, derivatives funding, absolute return assets and investments for which it was not possible to determine GHG emissions from our calculations.

Our methodology is intended to help UPP prepare a true and fair inventory of its financed GHG emissions and is based on the principles of relevance, completeness, consistency, transparency and accuracy.

Carbon footprint methodologies, including the attribution of investee emissions to investors are evolving at a rapid pace. We have calculated our metrics to the best of our ability as of the timing of publication, but our approach is subject to various limitations and challenges. For example, we rely entirely on the emissions data reported by companies and made available to us by a third-party service provider.

The company data is then used in our calculations, or it is used to generate the estimated emissions we use. Much of the reported data is not verified by a third party and indeed our third-party service provider does not provide investors a System and Organization Controls report to enhance our confidence in the integrity of their processes. A larger portion of carbon footprint relies on estimated data from our third-party service provider or as calculated by ourselves.

Calculating and disclosing our carbon footprint will be a journey of continuous improvement that will see us seek to improve the quality of our data and methodology over time. For instance, we plan to continually improve quality of the input data through engagement with companies and service providers and we also plan to enhance our analysis capabilities.

Results

Combined, the results in Exhibit 1 represent more than 70% of our net investment exposures as of December 31, 2021.

Exhibit 1. UPP’s financed greenhouse gas emissions

Scope 3 emissions associated with our energy (oil & gas) and mining investments totalled approximately 1 million tonnes CO2-eq.

We engaged PricewaterhouseCoopers LLP, an independent third party, to conduct a limited assurance engagement on the public equity portion (as noted by a * in Exhibit 1) of our 2021 carbon footprint metrics. Their assurance report is included in our Annual Report on page 53. Their limited assurance covers approximately 45% of our net investment exposures as of December 31, 2021.

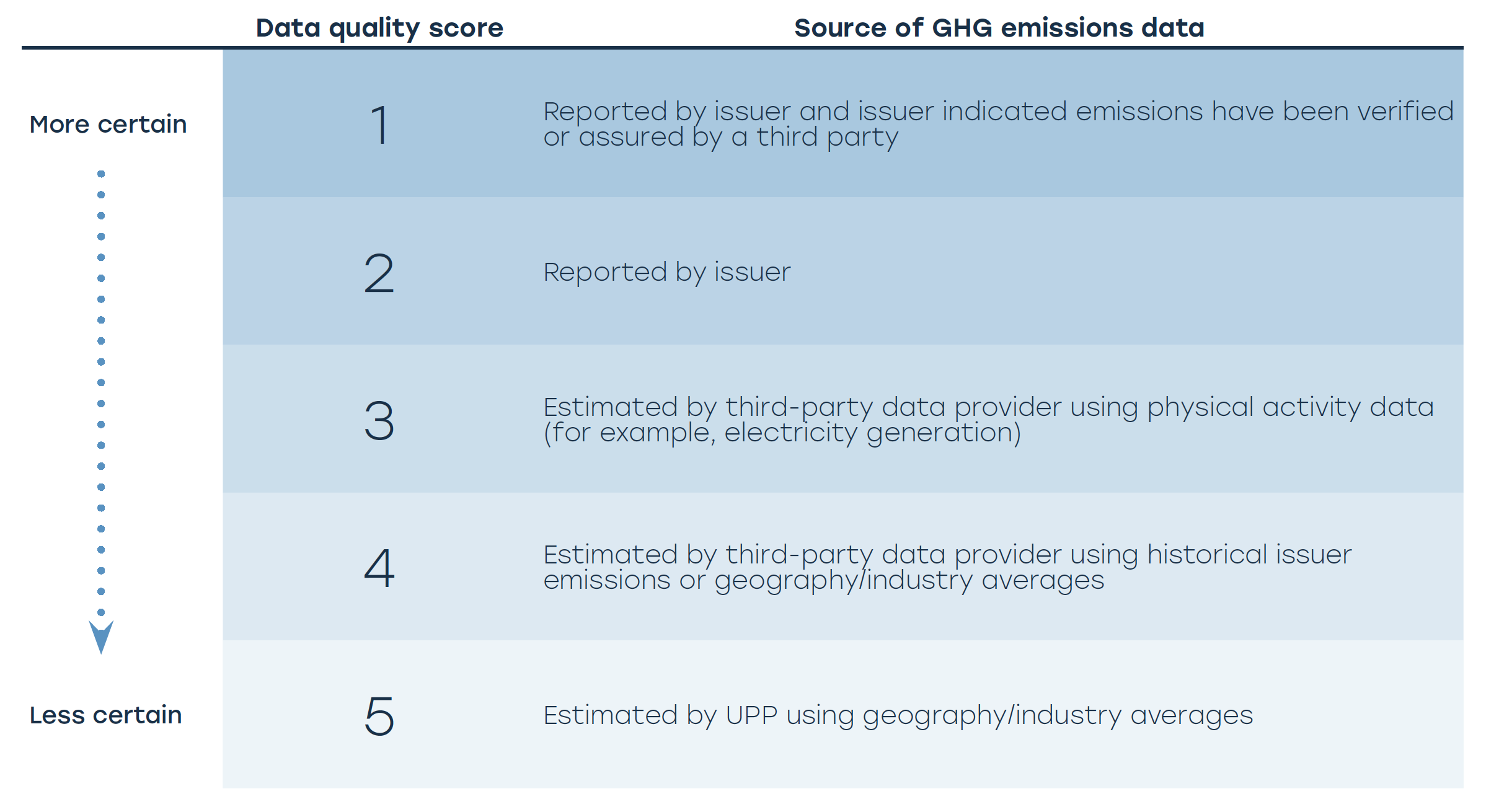

Data Quality

In the last row of Exhibit 1 we included the emission weighted data quality score of our calculations. Emissions data comes from a variety of sources and Exhibit 2 below describes where the data came from and how we assigned a data quality score to each investment (in line with the PCAF Standard). Reported and estimated GHG emissions were provided by a third-party data provider wherever possible and UPP calculated geography/industry averages when GHG emissions were not available from the data provider.

Exhibit 2. Description of data quality scores

Footnotes

1 IPCC, 2022: Climate Change 2022: Mitigation of Climate Change. Contribution of Working Group III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [P.R. Shukla, J. Skea, R. Slade, A. Al Khourdajie, R. van Diemen, D. McCollum, M. Pathak, S. Some, P. Vyas, R. Fradera, M. Belkacemi, A. Hasija, G. Lisboa, S. Luz, J. Malley, (eds.)]. Cambridge University Press, Cambridge, UK and New York, NY, USA. doi: 10.1017/9781009157926

2 Swiss Re Institute. (2021). The economics of climate change: no action not an option.

3 Kölbel, J. F., Heeb, F., Paetzold, F., & Busch, T. (2020). Can Sustainable Investing Save the World? Reviewing the Mechanisms of Investor Impact. Organization & Environment, 33(4), 554–574. https://doi.org/10.1177/1086026620919202

4 Paris Aligned Investment Initiative. (2021). Net Zero Investment Framework Implementation Guide. https://www.parisalignedinvestment.org/

Feedback

Tell us what you think about UPP’s climate action plan.