Feedback

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

Employee groups and university administrations created the Plan together, with a vision to help bring enhanced retirement security to Ontario’s university community.

A JSPP, or Jointly Sponsored Pension Plan, is a unique type of pension plan where both employees and employers share responsibility for decision-making and funding. It offers defined benefits to members, with contributions made by both the plan members and their employers.

Several of Ontario’s large public sector pension plans are JSPPs, including the Ontario Teachers’ Pension Plan (OTPP), OPSEU Pension Plan (OPTrust), Healthcare of Ontario Pension Plan (HOOPP), and Ontario Municipal Employees Retirement System (OMERS).

These plans are internationally known for their in-house investment management, independent governance, and ability to provide secure, high-quality pensions.

UPP was founded as a multi-university JSPP on July 1, 2021.

We proudly serve over 41,000 working and retired members across five Ontario universities and 14 sector organizations.

What other plans join, and when, is a decision of the Joint Sponsors. UPP’s job is to be ready, create a platform that will excite plans to join, and make the transition as easy as possible. We will always inform our members when new employers join.

Note: The answers in this section summarize the main features of your University Pension Plan Ontario (UPP) in simple terms. A complete description is contained in the UPP Plan Text. Every effort has been made to provide an accurate summary. However, if there are any differences between the information given here and the Plan Text, the Plan Text applies.

If you were earning pension benefits under your university’s prior plan when it converted to UPP, you automatically become a member of UPP on the day your university joins.

New and existing employees not enrolled in a prior plan

To join UPP, you must be in an eligible employment class, which varies by participating university. Please contact your employer’s human resources team for questions about your eligibility or to discuss new membership.

If you are in an eligible employment class, there are two ways to join the Plan:

Full-Time Continuous Employees – in most cases, full-time continuous employees automatically join the Plan on the first day of the month on or following the date you join a participating employer, or when you become full-time.

Other than Continuous Full-time Employees – can choose to elect to become a member of UPP on the first day of any month by completing the enrolment form after meeting at least one of the two following conditions in each of the last two consecutive calendar years before applying for membership:

you work at least 700 hours from an eligible class of employment with one or more employers that participate in UPP in a year.

The YMPE is a threshold set each year by the federal government, based on the average wage in Canada. We use it to calculate your pension and determine how much you need to contribute to the Plan.

University Pension Plan (UPP) allows funds to be transferred from a previous employer’s registered pension plan to UPP, under certain conditions, to be used to purchase pensionable service in the plan.

If eligible, transferring funds may allow you to:

Who is eligible?

If you earned pensionable service with your previous employer immediately before joining UPP, you may be eligible to transfer all or a portion of the value of your benefit entitlement to UPP if all the following apply:

Please note that if you previously initiated a transfer to your employer’s prior plan, you are not eligible for a transfer under the provisions of UPP. UPP does not allow transfers from RRSPs, except as a shortfall payment if the funds in your previous plan are not enough to purchase the full amount of pensionable service in UPP.

Requesting a transfer

The first step is to complete and return a Pension Transfer Application within 12 months of becoming a member of UPP (or within 12 months of joining your employer’s prior plan, whichever is earlier).

Please keep in mind that the process for requesting and completing a transfer can be lengthy. The table on the next page outlines important items and action steps.

Steps to transfer

| Step | Action |

|---|---|

| Submit an application | Complete and submit a Pension Transfer Application to UPP within 12 months of joining UPP. |

| Request data from your previous pension plan | To process your application, UPP will send a data request to your previous pension plan administrator, which will include a deadline for providing information. |

| Cost quote | Once all the requested data is received, UPP will determine the cost to purchase the pension credits from your prior pension plan in the UPP plan. The cost is the actuarial value of the pension based on UPP’s established administrative guidelines. The maximum UPP service you can purchase is limited to the service you earned in your previous employer’s plan. |

| Review options | A transfer in election package will be sent to you to review the total cost and your payment options. The package will include:

You will have a limited time to review the information and decide if you wish to purchase some, all or none of the pensionable service. If you do not respond by the deadline, your application will be closed and you will lose the opportunity to transfer. Transferring funds from a previous plan to UPP is an important decision. It’s a good idea to seek advice from an independent financial advisor. |

| Transfer funds | If you decide to transfer funds from your prior pension plan to the UPP plan, you will contact your prior plan administrator to request a transfer of funds to UPP, along with the required forms from your transfer package. The transfer of funds from your previous pension plan to UPP may take several months to complete. When you transfer pension service, UPP is required to calculate a “past service pension adjustment” (PSPA) and report it to the Canada Revenue Agency for approval. A PSPA represents the value of the pension you wish to purchase. It reduces your RRSP contribution room for the next taxation year. Funds transferred from your prior pension plan, RRSP or LIRA will reduce the PSPA. Shortfall payments If the funds in your previous plan are less than the total cost to purchase the full amount of pensionable service in UPP, you may choose to make a one-time lump sum cash payment and/or transfer funds from an RRSP to purchase the remaining service. No other payment options are allowed. If your payment is not received by the due date indicated in your transfer package, you will only be credited with pensionable service based on the funds received from your previous pension plan. |

| Complete the transfer | Once the payment(s) have been processed, you will be notified that the transfer is complete. You will receive an income tax receipt for any lump sum cash payments. |

For more information

If you have any questions or need additional information, please contact UPP’s Member Services team.

You can only use funds from a registered retirement account, such as an RRSP, to pay for a transfer in “shortfall”. A shortfall occurs if you transfer in service from a prior employer’s pension plan and that plan does not have sufficient funds to satisfy the UPP cost.

If you were not eligible to join UPP upon your hire date and joined at a later date once you became eligible, you cannot purchase service for the prior years where you were not contributing to the plan. Your hire date and enrolment date will differ on your UPP documents to reflect this.

The Plan’s contribution rates are set by UPP’s Joint Sponsors. As a UPP member, you currently contribute:

Under UPP, your annual contribution is determined by taking 9.2% of your annual pensionable earnings up to the Year’s Additional Maximum Pensionable Earnings (YAMPE), plus 11.5% of your annual pensionable earnings over the YAMPE. Your contribution is 100% matched by your employer. The YAMPE is a threshold set each year by the federal government, based on the average wage in Canada. In 2025, the YAMPE is $81,200.

Different contribution rules apply during certain types of leaves of absence and special programs.

IMPORTANT: Under UPP, your earnings for contribution formula purposes will be capped at $215,300 (2025) increased annually in line with increases to the maximum pension rules under the Income Tax Act.

Footnote: UPP’s founding Universities are also responsible for any pre-conversion deficit funding, addressed through amortized special payments.

No, UPP does not allow for additional voluntary contributions.

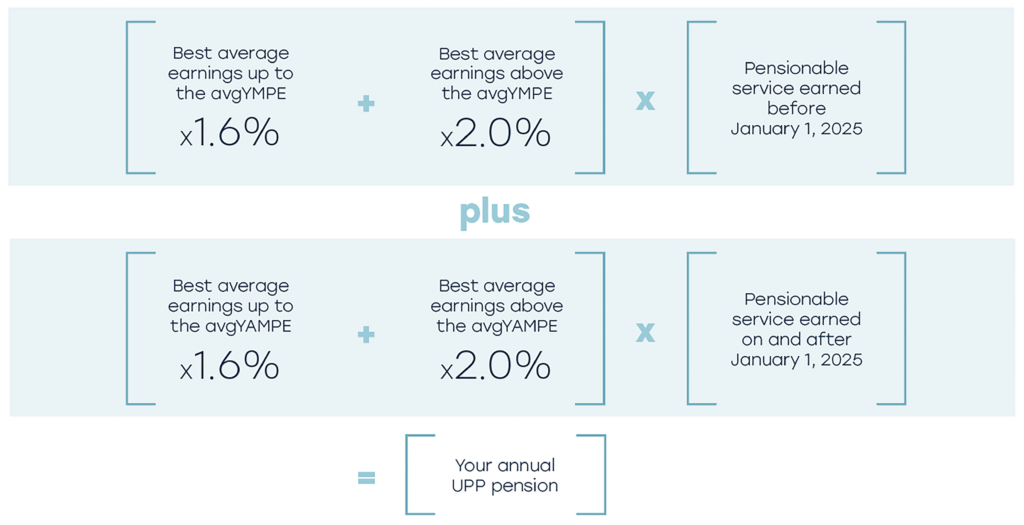

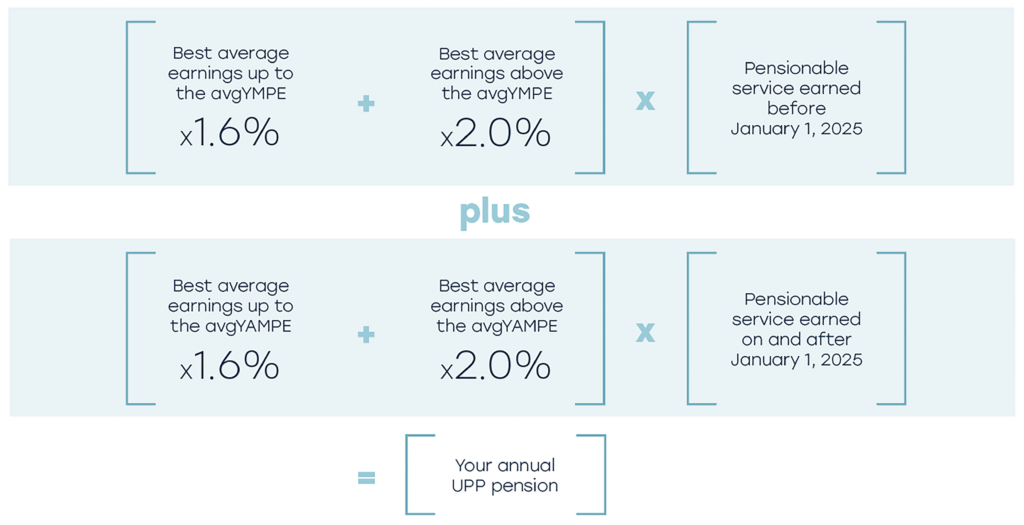

As a member of UPP, your pension is paid for life. The pension you receive is based on a formula that considers a few key components:

Your Best Average Earnings: average of your highest 48 months of pensionable earnings as a member, up to the maximum pension limit under the Income Tax Act.

Average YMPE: average of the Year’s Maximum Pensionable Earnings (YMPE) established by the federal government in the last 48 months before you retire. For service earned before January 1, 2025, the YMPE is used.

Average YAMPE: average of the Year’s Additional Maximum Pensionable Earnings (YAMPE) established by the federal government in the last 48 months before you retire. For service earned on and after January 1, 2025, the YAMPE is used.

Your years of Pensionable Service: the amount of continuous service during which you’ve contributed to UPP and your prior plan, including any service you transferred in.

For each year of pensionable service after joining UPP, you will accrue an annual pension benefit, payable at your Normal Retirement Date, based on:

Like all registered pension plans, UPP’s pension benefit is subject to the maximum pension limits under the Income Tax Act.

Under UPP, pension payments are on the first day of the month.

Your pension is calculated using the same formula as a full-time member. The pension formula uses your average annualized pensionable earnings and your pensionable service.

Annualized earnings are earnings that you would earn in a year if you were working on a full-time basis. For example: if you work 20 hours per week (50% of the full-time equivalent) and earn $35,000.00 annually, your annualized earnings would be $70,000.00 and your pensionable service would be 0.5 years of service to reflect your actual working hours.

No, while retirement savings vehicles like an RRSP may be accessed through programs like the Home Buyer’s Plan, funds in a defined benefit (DB) plan are locked in and cannot be withdrawn for that purpose. A DB pension plan is designed to provide you with a predictable and secure monthly lifetime pension.

If you leave for another UPP employer within 12 months of the date your employment ended, and you didn’t transfer any of your pension assets in your departure, your contributions will simply begin again, your memberships will combine, and your pension will be recalculated when you retire or leave for a non-UPP employer.

If you leave your job with a UPP employer, you will need to decide what to do with your UPP pension. You will receive a statement of options*, as summarized below:

For members under age 55, you can:

For members aged 55 or older, you can:

You should always seek independent professional financial advice when making decisions about your UPP pension.

*Please note that if you happen to rejoin UPP before receiving your termination options package, re-entering the Plan becomes your ‘default’ selection and a lump-sum transfer is no longer available.

The commuted value is the total estimated value in today’s dollars of the lifetime pension you have earned and would be payable at retirement. It is an actuarial calculation that involves many factors, including your age, your assumed retirement age, mortality rates and interest rates.

Because the commuted value is a current estimate of a future value, the lump sum you may receive based on a commuted value may be greater or less than the actual pension payments that you would have received if you had elected to receive a pension from the Plan.

The commuted value is the total estimated value in today’s dollars of the lifetime pension you have earned and would be payable at retirement. It is an actuarial calculation prescribed by pension standards legislation that involves many factors, including your age, your assumed retirement age, mortality rates and interest rates.

Because the commuted value is a current estimate of a future value, the lump sum you may receive based on a commuted value may be greater or less than the actual pension payments that you would have received if you had elected to receive a pension from the Plan.

In Ontario, all members of a registered pension plan (like UPP) are vested immediately upon joining the plan.

If you leave your employment with an employer who participates in UPP and move to an employer who does not participate in UPP, neither you nor your new employer can make contributions to UPP.

There may be times when your career or life choices alter your earnings or hours worked, which could affect your pension benefits. UPP offers many ways to ensure you continue building benefits and maximize your pension along the way.

During an employer-approved leave of absence, you will remain a member of UPP, but you will only earn pensionable service for that period if contributions are made. The chart below shows the most common type of leaves and how contributions can be maintained.

| Type of Leave | Your Contributions | Your Employer’s Contributions |

|---|---|---|

| Statutory (Ex: parental leave) | Optional – you decide if you want to continue your contributions or not | Your contributions are matched by your employer (as applicable) |

| Unpaid | Optional – you decide if you want to cover your and your employer’s contribution amounts | Your employer does not contribute |

| Paid | Required – contributions continue without interruption | Your contributions are matched by your employer |

| Research & Study | Required – contributions continue without interruption | Your contributions are matched by your employer |

| Long-term Disability | You do not contribute | Contributions will be made by your employer if you are (or would be) eligible for long-term disability benefits |

There are other types of leaves such as phased retirement, reduced workload arrangements, self-funded leaves, temporary layoffs, and paid leaves of absence. If any of these leaves apply to you, please contact your employer’s human resources team or UPP Member Services to learn more about how they impact your pension.

Under UPP, you decide when to start collecting your pension.

The normal retirement date is the end of the month in which you reach age 65, but you can continue to work (and earn pension benefits) up to November 30th of the year you turn 71.

You can retire with an early unreduced pension as early as age 60 if your age plus your eligibility service equal at least 80 points. This is known as the “80 factor.” For example, if you were 62, you would need at least 18 years of eligibility service to qualify for an early unreduced pension (62 + 18 = 80 points). Because of the stipulation that you must be at least age 60 to retire early, a member aged 58 with 22 years of eligible service would not qualify for an early unreduced pension.

You can retire with an early reduced pension as early as the end of the month in which you turn 55. For example, if you decided to begin your pension at age 62.5 with 15 years of eligibility service, your pension would be reduced by 12.5% [65-62.5] x 5% per year). The reduction reflects the fact that by choosing to start your pension at a younger age, you will probably receive your pension for a longer period. In general, your pension starts on the first day of the month following your retirement date.

You can postpone your retirement until November 30th of the year in which you reach age 71. After this date your contributions will stop and you must elect a retirement income option.

If you’ve earned a pension under a participating university’s prior plan, different early retirement eligibility rules and reductions might apply to your prior service. For more information and to get a personalized retirement projection, please contact your university pension administration team.

UPP’s Pension Estimate Calculator is a valuable tool for retirement planning, designed to help you make informed decisions about your future. It provides tailored projections of your expected retirement income under various scenarios, based on an array of factors. Learn more about the Pension Estimate Calculator here.

Your UPP pension is determined by a formula that is based on your pensionable earnings and service. The longer you work and contribute to UPP, the more pensionable service you will have and the bigger your pension will be.

You can retire with no reduction to your pension at any time after reaching the Normal Retirement Date or UPP’s Early Unreduced Retirement Date, whichever is earlier.

The Normal Retirement Date is the last day of the month in which you turn 65. The Early Unreduced Retirement Date is the day your age and your eligibility service is 80 or more and you are at least 60 years of age.

You can retire as early as age 55, but if you have not yet reached your Early Unreduced Retirement or Normal Retirement Dates, your pension will be reduced by 5% for each year you are under age 65.

We recommend submitting your pension application at least 90 days in advance of your intended pension start date to ensure you have enough time to review your options and make an informed decision.

If you are an active member, the first step of starting your pension is to notify your employer of your decision to retire. Documentation and notice requirements vary by participating employer and you should consult your employer’s human resources team on what those are.

If you are a deferred member of UPP, you can submit your notice directly to UPP Member Services via Secure Message through the myUPP Member Portal or phone.

As a member of a defined benefit pension plan, once you reach retirement age (as early as age 55), you are entitled to a guaranteed, monthly pension for life. Your pension includes advantages such as inflation protection (indexation) and survivor benefits. In most cases, once you reach retirement age, funds are locked in as a monthly pension, and you can’t take out the value of your pension as a lump sum.

Learn more about the commuted value here.

For more information about your pension entitlements, please refer to the UPP Member Handbook. If you were a member of a plan before they joined UPP, the applicable Pre-conversion Guide can help you understand your pre-conversion entitlements.

The Pension Estimate Calculator is designed to give you reliable estimates of your monthly pension, which is based on a set formula that takes into account predictable factors such as your pensionable earnings and service. Since the commuted value is less predictable – fluctuating with changes in interest rates – the tool does not provide commuted value estimates. Learn more about the commuted value here.

Survivor benefits are an important feature of the Plan, to help provide for your loved ones when you pass away, whether before or after retirement. Completing the Beneficiary Designation Form when you join the Plan helps ensure the right benefits are provided to the right people. The form is available from your university pension administration team.

If you have a spouse, as defined by the Plan, that person is automatically entitled to your death benefits unless they sign a waiver.

If you do not have a spouse or your spouse waived their rights to survivor benefits, you can designate a beneficiary to be next in line for death benefits. If you do not have a spouse or a beneficiary, this money will be paid to your estate. Please see UPP’s Member Handbook or contact Member Services.

If you pass away before retirement, your beneficiary will receive the commuted value of your pension. The commuted value is the lump sum value of your pension that would be payable at retirement calculated in accordance with Ontario pension standards legislation.

If you pass away after retirement, UPP’s normal form of pension for a member without a spouse is a lifetime pension for you with a 10-year guarantee. This means if you retire and pass away before receiving a total of 120 monthly payments, the balance of payments will be paid to your beneficiary.

If you have more than one beneficiary, the benefit will be split in percentage shares you designate. If you do not have a beneficiary, the benefit will be paid to your estate.

There may be impacts on your pension if you return to work for a participating UPP employer after you start collecting a pension.

If you return to work for a participating UPP employer (in an eligible employment class) on a continuous full-time basis, your pension payments will stop and you will become a contributing member of UPP. You’ll build additional benefits and your pension will be recalculated when you retire again.

If you return to work for a participating UPP employer (in an eligible employment class) on a basis other than continuous full-time, you will have the option to continue receiving a pension, or to stop your pension payments and become a contributing member of UPP.

If you decide to start contributing to UPP again, you will build additional benefits and your pension will be recalculated when you retire again. If not, you will continue collecting your pension and working, but will not accrue any further service under UPP.

If you return to work for a non-UPP employer, there is no impact to your pension.

Each year by June 30th, you will receive an annual statement providing a snapshot of your benefits as of December 31st of the previous year. Your statement includes the benefits you earned in your prior plan (if any), and your earliest retirement date and normal retirement date.

Inflation protection is a valuable benefit designed to increase the amount of your monthly pension through a cost-of-living adjustment based on the increase in the Canadian Consumer Price Index (CPI).

Prior plans – If your prior plan had inflation protection, it will still apply to your benefits earned under that plan. Prior plans have varying dates and definitions of inflation protection that only apply to benefits earned under those prior plan provisions. Please contact your university pension services team for details.

UPP – When you retire and begin receiving your pension, the portion attributable to UPP benefits will be subject to funded conditional indexation. This means that any indexation adjustments will be determined by UPP’s Joint Sponsors. UPP’s target funded conditional indexation is 75% of the increase in CPI for Canada but may be less based on the Plan’s overall financial health and Funding Policy. Indexation of your UPP benefits is not guaranteed, meaning if an indexation adjustment is made in any given year, it does not necessarily mean an adjustment will be made in any future year.

UPP seeks to operate a fund that is resilient and responsive to all types of risks and opportunities, with pension security at the centre of our efforts.

Learn more about UPP’s investments and how they benefit our members.

Statement of Investment Policies and Procedures, or SIPP, is a regulatory document required under the Ontario Pension Benefits Act for all registered pension plans.

As its names suggests, a pension plan’s SIPP contains information about the investment policies and procedures that it follows in administering its investment portfolios. It covers information such as the categories of investments and credit vehicles used by the pension fund, the diversification of the portfolio, the asset mix, and rate-of-return expectations, as well as the liquidity of the investments (i.e., how easily they can be sold).

The SIPP also covers fund governance, funding valuations and how environmental, social and governance (ESG) factors are incorporated. The ESG requirement came into effect in 2016.

UPP’s Board of Trustees, as the Plan’s legal administrator, must file the SIPP with the Financial Services Regulatory Authority (FSRA) within 60 days of plan registration, which occurred on July 1, 2021. FSRA is Ontario’s pension regulator.

UPP’s SIPP replaces the SIPPs of any participating pension funds. It reflects our investment and asset position at the Plan’s inception. It will be revisited at least annually and adapted as necessary. Amended versions will be posted accordingly.

We apply a number of measures and tools to maximize the Plan’s funded status and stability while maintaining stable, sustainable contribution and benefit levels over time.

One such measure is an innovative risk-sharing mechanism where all new plans entering UPP must be fully funded or establish a payment schedule to become fully funded over an agreed-upon initial period, subject to pension legislation. Over the long term, Plan risks – including funding risk – are shared equally and addressed jointly between Plan members and employers. This phased mechanism was designed specifically to ensure no negative impact to existing members from new organizations coming into the Plan.

Meanwhile, our investment program is specifically designed to meet our pension commitments over the long term, with a core focus on promoting the health of the fund and the broader market environment on which the fund relies. As a long-term investor, our investment risk programs are designed to buttress our fund from short term market shocks.

Responsible investing is the integration of environmental, social and governance (ESG) considerations into investment management processes and stewardship practices. It is focused on factors that have a material impact on financial performance and the environmental, social, and financial systems upon which capital markets rely.

ESG refers to environmental, social, and governance factors that may impact or be impacted by corporate or investment activities. Environmental factors relate to the quality and functioning of the natural environment and natural system. Examples may include climate, greenhouse gas (GHG) emissions, and biodiversity. Social factors concern the rights, well-being, and interests of individuals and communities (e.g., employees, customers, broader society). Some of these may include human rights and labour rights in operations and supply chains, equity, diversity, and inclusion, and employee health and safety. Policies and procedures that oversee the direction, control, and monitoring of companies and assets are considered governance factors. This includes assessing board structures, diversity at the board level, executive compensation, shareholder rights, conflicts of interest, and other related topics concerning policies and procedures.

At UPP, addressing these factors is integral to both our investment strategies and daily operations. Within our portfolio, we incorporate them at every stage of the investment process—from due diligence to asset management and selling assets. This commitment extends to our partnerships with external investment managers. To learn more, read our responsible investing approach.

Within our operations, we have identified important sustainability topics that are likely to have the most impact on our operations, as well as strategies to address them. This helps focus our resources on key operational risks and opportunities, ultimately to support our purpose of investing with integrity and serving members with care. Read our Organizational Sustainability Strategy (OSS) for more details.

UPP utilizes a materiality-based approach to determine our stewardship focus areas, while also considering systemic issues. For instance, our Inequality Stewardship Plan aims to address critical social issues that can adversely impact the health of financial markets, which, in turn, can negatively impact UPP’s ability to fund pensions.

Our stewardship activities encompass several key topics, including climate change, social issues, and governance. These areas can pose significant investment risks and impact individuals and communities. Additionally, they may intersect with and exacerbate each other. Learn more about how we are addressing specific challenges related to these factors in our investment portfolio.

UPP’s Responsible Investing Policy provides a framework for how we seek to incorporate material ESG considerations in our investing and stewardship activities in practical, consistent, and comprehensive ways. This policy formalizes the commitments and beliefs summarized in our Statement of Investment Policies and Procedures, and both policies are on our Investment Policies webpage.

UPP seeks to achieve greater influence through collaboration with other investors and stakeholders such as industry groups, policymakers, standard-setters, the academic community, and civil society. We join and actively participate in collaborative initiatives aligned with our priorities to strengthen and extend the reach of our engagement and advance industry practices and market-wide policy. At all times, we retain independence in all decision-making, including in our investment decisions.

UPP is committed to achieving net-zero portfolio greenhouse gas emissions by 2040.

This target reflects our long-term approach to investing responsibly by accounting for material risks that impact our investment portfolio, as well as our belief that climate risk is a systemic issue that will continue to present risks and opportunities. Our strategy, as outlined in our Climate Action Plan includes setting interim emission reduction targets, integrating climate risk into investment decisions, and actively engaging with portfolio companies to support their own transitions.

Learn more about our Climate Action Plan.

Net-zero greenhouse gas emissions will be achieved when the human-caused emissions associated with our investments are as close to zero as possible and the remainder of human-caused emissions are removed from the atmosphere.

Our planned commitment applies to UPP’s investment portfolio for now, with the goal of including our own operations as we get measurements in place.

While divestment from an entire industry is a fast way to remove assets from a portfolio, it can result in passing ownership of such assets to someone who might care less about their real-world impacts. We want to support the transition to a net-zero society and address the greenhouse gas emissions from the companies we invest in – transforming the economy toward a better, more resilient state. This takes time and a range of approaches, including targeted exclusions.

We will stay at the table and hold companies accountable for making real progress on decarbonization. If a company is resistant to change and other measures are not encouraging improvements, we believe selling or excluding assets can be appropriate – but we will not apply a pre-emptive, blanket policy of divestment.

Responsible investing requires a range of tools to be successful, including engagement. As part of our inaugural investment activities, UPP joined shareholder and investor groups to help amplify our voice on key areas of focus.

You can read more about the tangible and positive impacts of those engagement activities below:

UPP’s Investment Exclusion Policy and the accompanying Investment Exclusion List – General Parameters are available on our Investment Policies webpage. The Investment Exclusion Policy outlines how UPP manages financial and reputational risks related to environmental, social, and governance issues—such as investments that may contribute to or be directly linked with severe adverse social or environmental impacts. The General Parameters define the criteria used to determine exclusions.

Together, these documents are intended to help UPP provide stable retirement benefits to members at a reasonable cost for members—now and into the future.

Transparency is fundamental to how we do business at the UPP and building trust with our members. You can view our annual reports, which includes comprehensive disclosure related to the Plan’s investment performance and our use of external managers, balancing transparency with confidentiality and other obligations of UPP.

UPP’s carbon footprint metrics can be found in our Climate Action Plan.

At UPP, we are deeply committed to equity, diversity, inclusion, and reconciliation as the bedrock of our intentional culture. We believe that one way to demonstrate this commitment is by reflecting the rich diversity of the population we serve at all levels within our organization.

We have a board-approved roadmap that outlines the steps we will take to increase diversity, ensure equity through our programs, retain team members from equity-deserving groups, and promote inclusion within our workforce. Our goal is to ensure that our culture, programs, and decision-making processes are not only bias-free but actively benefit from diverse perspectives and lived experiences. We are building an organization where everyone is welcome and can thrive.

Equity, diversity, inclusion and reconciliation are an important part of who we are and what we do at UPP. As an organization, we are committed to taking action respectfully and intentionally as outlined in Call to Action #92 from the Truth and Reconciliation Commission of Canada. As we learn, we continue to seek ways we can help address the barriers faced by Indigenous peoples and support a more positive chapter in the relations between indigenous peoples and non-indigenous Canadians. Through our association with the Shareholder Association for Research and Education (SHARE), companies in UPP’s investment portfolio are being engaged in outcome-focused dialogues to make tangible commitments to reconciliation, including the adaption of Indigenous rights policies, employment targets and procurement from Indigenous-owned businesses.

We are always looking for ways to improve your experience. Please tell us about your experience below.

Your responses will be kept confidential. To protect your privacy, please do not enter your account or personal information.

Customize your experience through accessibility adjustments